Mindful Investing Reset When Stillness Finds Its Rhythm

A personal reflection on clarity, patience, and emotional alignment

There’s a moment in every investor’s journey that feels like a deep breath. Not a pause out of confusion, but a stillness born from clarity. That’s where I found myself recently—not chasing charts or refreshing tickers, but simply sitting with the choices I’d already made. It was my personal mindful investing reset.

This wasn’t about market timing or technical analysis. It was about emotional alignment. A mindful investing reset that felt more like a lifestyle shift than a financial one.

Stillness Isn’t Stagnation

After closing a position that no longer felt right, I didn’t rush to reallocate. The funds were there, the options were many, but my instinct said: wait. Let the dust settle. Let the strategy breathe.

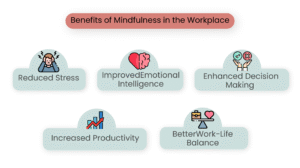

Stillness, I’ve learned, isn’t passive. It’s preparatory. It’s the space where clarity sharpens and noise fades. In that quiet, I revisited my checklist—not just financial metrics, but emotional ones. Sites like MoneyControl helped me compare dividend trends without getting lost in noise.”

Was I comfortable with the risk? Did the potential reward feel worth the stress? Was I trading from conviction or compulsion?

That pause became the foundation of my mindful investing reset.

A Shared Rhythm

Around the same time, my mom mentioned she was curious about investing. She didn’t want complexity—just something steady, something she could trust. I smiled. Much like the calm reflections on Best Places of Interest, her approach reminded me that investing is deeply personal.”

Maybe she’s the real mindful investor.

We talked about value, about patience, about how sometimes the best trades aren’t the ones that make headlines, but the ones that let you sleep peacefully. Her approach reminded me that investing isn’t just tactical—it’s deeply personal. It’s about finding your own version of a mindful investing reset.

When Strategy Meets Delay

Of course, not everything flows perfectly. My broker showed one balance, my trading limit showed another. A classic T+2 settlement lag. I had the funds, but not the freedom. And yet, I didn’t panic.

Instead, I treated it like a tide. I knew it would rise. I knew the moment would come. So I waited. Again.

That’s the rhythm I’m learning to trust—not the market’s, but my own. And that rhythm is what defines a true mindful investing reset.

Trusting the Quiet

There’s a quiet confidence that comes from not needing to act. It’s the kind of trust that builds over time—not just in your strategy, but in yourself. I didn’t need to chase momentum or fill every gap with movement. I needed to trust the rhythm I’d chosen. And in that trust, I found something rare: a portfolio that felt not just profitable, but peaceful.

✍️ Closing Thoughts

This mindful investing reset wasn’t about picking the perfect stock. It was about choosing emotional alignment over urgency. About letting strategy emerge from stillness. About remembering that sometimes, the most powerful move is no move at all.

So if you’re in a similar place—between trades, between decisions—don’t rush. Sit with it. Let the rhythm find you. Your own mindful investing reset might be closer than you think.

- Q: What is a mindful investing reset?

- A: It’s a pause in your investing journey to reflect, realign, and choose emotional clarity over urgency.

If you’re exploring your own mindful investing reset, resources like ET Wealth offer helpful insights—but the real clarity comes from within.”

Have you experienced your own mindful investing reset? Drop a comment or share your rhythm—it might help someone else breathe easier.